- This New Way

- Posts

- AI Pays Taxes, Builds Product Roadmaps & Centralizes Knowledge

AI Pays Taxes, Builds Product Roadmaps & Centralizes Knowledge

How Solon Angel is using AI to replace late fees, product managers, and even board meetings.

It started with a video game. When DeepMind showed off software that could learn and improve in real time, Solon Angel saw more than a tech demo, he saw the future of financial data analysis.

That insight led to MindBridge, a pioneering AI company that brought machine learning into the conservative world of accounting. Today, Solon is back with Remitian, a new startup using AI to eliminate late tax fees and turn tax compliance into a proactive, fully-automated system.

Keep reading to get the step-by-step tutorials and AI tools mentioned in this episode. 👇

New resource:

How to Prevent Shadow IT Without Slowing Innovation

A practical guide for the secure adoption of AI meeting notetakers — featuring a rollout checklist, a sample AI adoption policy, and communication templates for organization-wide rollout.

Tutorial 1: Build a product management system with AI

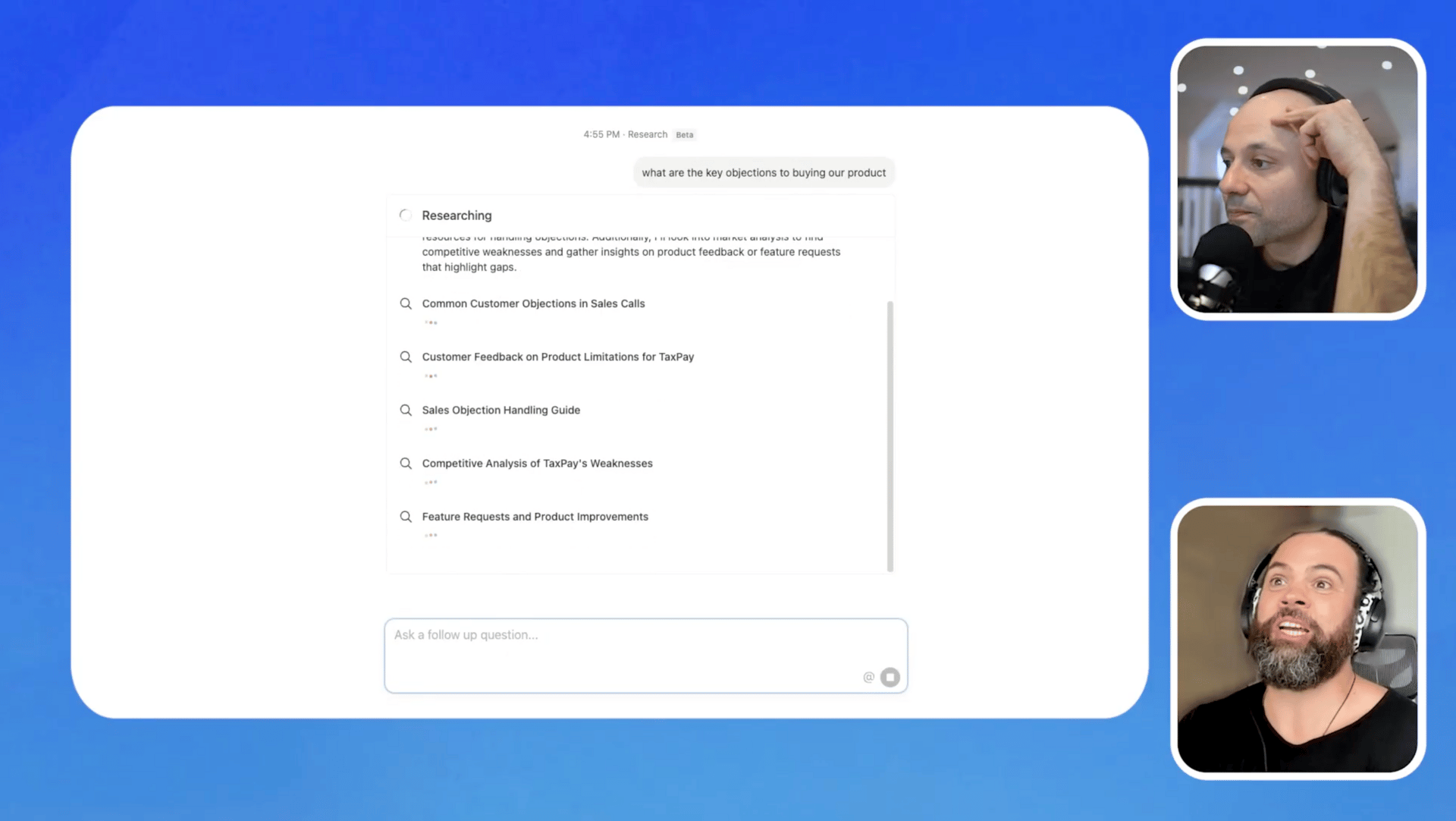

Can’t hire a Product Manager? No problem. Remitian built an internal AI product manager that listens to every customer call and outputs clear requirements.

Auto-transcribe all calls.

Record and transcribe calls with tools like Fellow for accurate AI-ready transcripts.Summarize and extract needs.

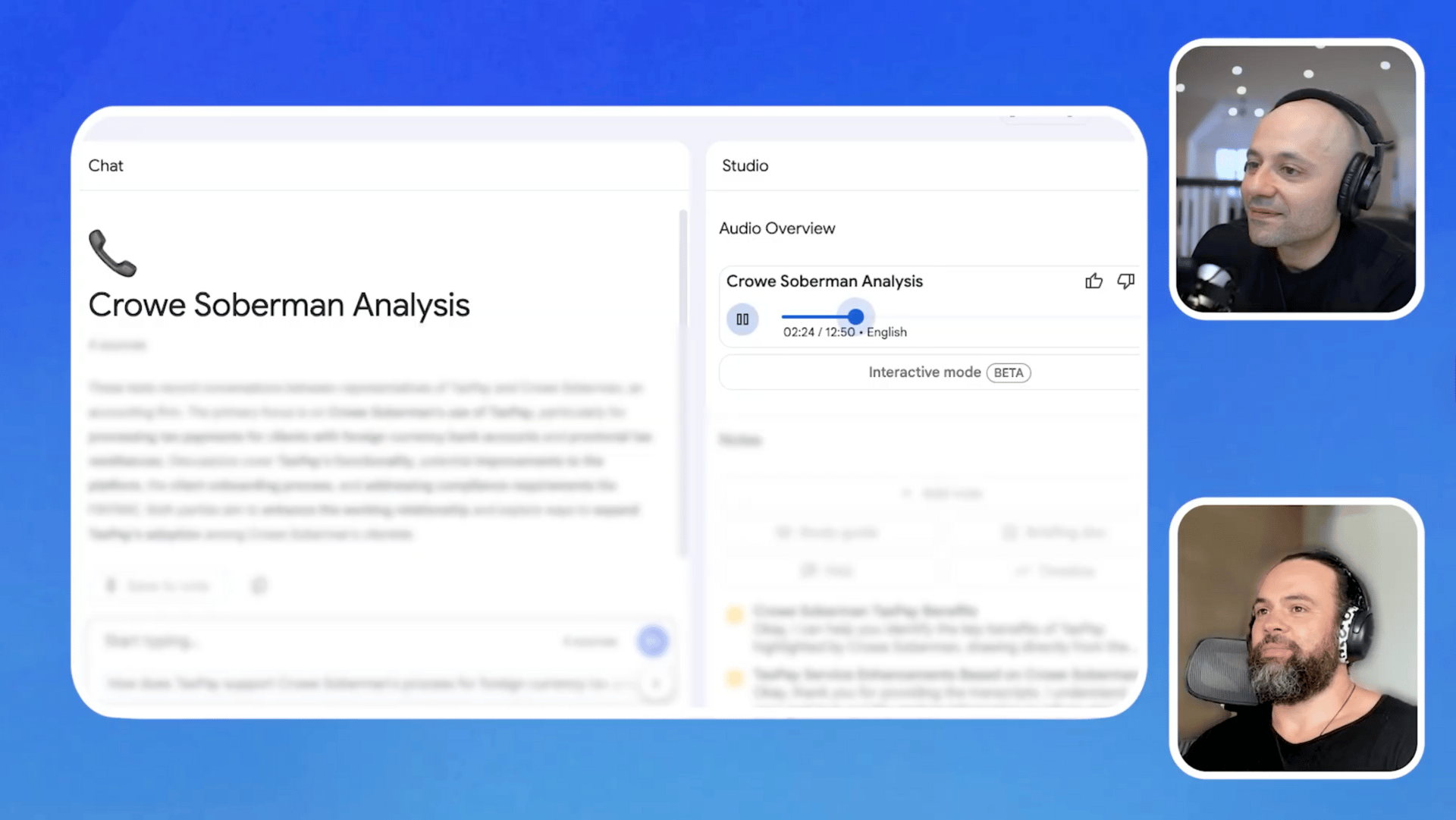

Prompt AI to detect feature requests, pain points, and improvement suggestions.Feed transcripts into Notion AI or Notebook LM.

Use research mode to pull patterns from support, sales, and product conversations.Push suggestions into Slack.

Automate Slack posts that tag engineers with structured product recs, removing the PM handoff entirely.Bonus: Add computer vision.

Train the AI to “see” the UI and link comments to on-screen elements for deeper feature mapping.

Tutorial 2: Use Remitian to automatically pay your taxes

Busy business owners and accountants are drowning in manual tax tasks, from juggling payment deadlines to figuring out which bank account to pull from. Remitian solves this by acting as your AI-powered tax assistant, preventing costly late fees and penalties ($60B+ annually in North America!) with smart automation.

Here’s how it works, step by step:

1. Connect Your Bank Accounts

Upon onboarding, link all relevant business bank accounts securely to Remitian’s platform. The AI needs real-time access to assess available balances and make payment decisions.

2. Sync Your Tax Calendar

Upload or connect your tax deadlines (federal, state/provincial, city, property, etc.).

Remitian creates a dynamic schedule of upcoming tax obligations and alerts.

3. Let the AI Agent Monitor Funds and Deadlines

The AI agent constantly checks your account balances and upcoming tax payments. If a scheduled payment is coming and funds are insufficient, the agent reaches out (via voice, text, or email).

Example Alert:

“Hi Aaron, your operations account won’t cover the $10K tax payment due tomorrow. Would you like me to split the payment?”

Watch Solon’s live AI agent demo here.

AI tools mentioned in this episode:

Fellow – The most secure AI meeting assistant and notetaker

Remitian – Tax payments on autopilot

Notebook LM – Google’s document-to-podcast summarizer

Notion AI – Workspace search and structured analysis

Cursor – AI-native coding IDE

GPT-4o – Language + vision agent backbone

Plaid – Financial account data aggregation

Why it matters: These playbooks aren’t just automation, they’re transformation. AI is reducing team size, compressing timelines, and rewriting entire codebases in weeks, not years.

👉 Subscribe to This New Way: YouTube Channel

📩 Was this email forwarded to you? Subscribe here

Until next time,

Aydin Mirzaee

CEO at Fellow & Host of This New Way